About.com states (only half-jokingly, I think) “If you considered only the financial implications of having children, you might end up childless.” Luckily, most people do not base their decision to have children on whether or not they can afford it. Somehow, families manage to feed, clothe, and educate their children, but the expenses involved can be overwhelming and stressful. Planning in advance can help avoid some of the stress surrounding the arrival of your little (otherwise) bundle of joy.

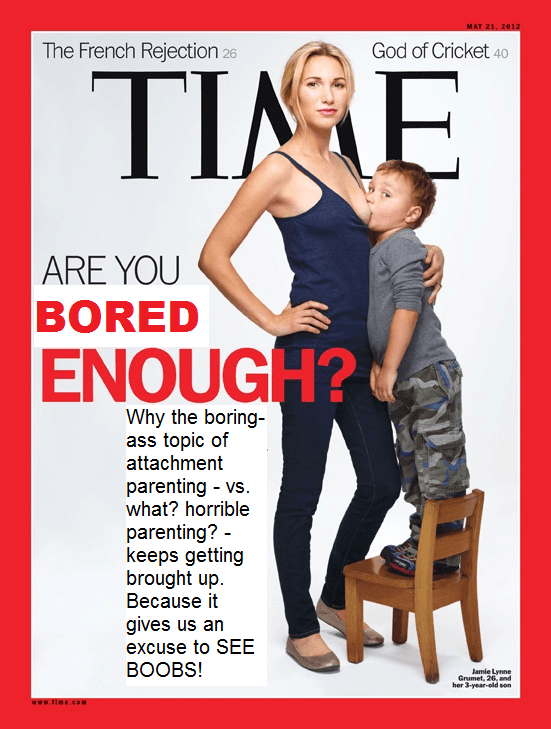

You can get an idea of what expenses are involved at MSN Money and Essential Baby. They give some suggestions on how to cut costs too, such as borrowing baby furniture, strollers, and clothes, or buying second hand. Using cloth diapers, while it does involve a lot of work, is more economical and environmentally-friendly. And of course, aside from the health benefits of breastfeeding, it’s a free food supply for at least the first 6 months of your baby’s life!

The NY State Society of CPA’s has some suggestions on how to plan financially for baby. These include revising your budget, applying for a social security number, reviewing your insurance coverage, revising your W-4, naming a guardian in your will, opening a child care flexible spending account, and (of course) consulting with a CPA. They can advise you on tax benefits and how to modify your financial plan to accommodate the new family member.

As far as insurance goes, they advise to you have a life insurance policy which will provide for your family in the event of a parent’s untimely death, and disability insurance to replace your income should you become disabled. Of course you need to make sure that your child will be covered by your medical insurance policies.

In this article called 10 financial changes to make for your new baby you can find some more helpful hints on how to plan and save at a time you may need it most (some of these are applicable only in the UK). If you have debts or credit problems, ClearPoint Credit Counseling Solutions has advice on how to get it together in stages.